Latest survey: Chinese millennials' retirement savings rates hit new high,financial wellness is critical to enhancing millennial well-being

Shanghai, China, 27 October 2021: Fidelity International and the Ant Fortune platform today released the 2021 China Retirement Readiness Survey . The results show that retirement savings have been growing in focus for Chinese millennials (aged 18-34) as they achieved the highest retirement savings rates since 2018. However, the concept of retirement investing needs to be further strengthened. Data indicates that improving financial wellness and strengthening retirement reserves are critical to enhancing the overall well-being of Chinese millennials.

China has been accelerating the development of its third-pillar pension system in recent years in order to enhance retirement security and strive for common prosperity. While increasing awareness about retirement savings will provide an important foundation for the development of the third-pillar, continuous investor education that encourages long-term investments will also play a vital role.

Significant growth in retirement savings

The survey results show that the monthly savings rate of young people jumped from 20% in 2020 to 25% this year, with monthly savings reaching an average of RMB 1,624.

The retirement savings rate is affected by multiple factors, with 76% of the young generation indicating that they began to increase their emergency savings last year, mainly due to the effects of the pandemic. Meanwhile, compared with those over 35 years of age, the young generation has a higher goal for retirement savings. They expect to save nearly RMB 1.55 million for a good retirement life, which is considerably higher than the target of RMB 1.39 million by people over 35 years of age.

On average, the young generation starts saving for retirement at the age of 31, which is still rather late for them to accumulate savings per their retirement goals.

Imperative to encourage long-term investment

Though the young generation is making progress in increasing their savings, they still lack sound and adequate investments.

The survey found that nearly a quarter of young respondents make cash the primary component for their retirement savings. 23% percent of young respondents said that they lacked the relevant investment skills and knowledge, which made them less inclined to start investing.

Target-date funds (TDFs) aim to provide a one-stop solution to retirement investment for individuals, playing a critical role in retirement investment strategies globally. To support the development of the third pillar of China's pension system, hundreds of pension target funds successfully obtained approval and have been rolled out in China since 2018.

However, the survey findings indicate that only 16% of young respondents who already possess investment experience have heard of TDFs. Of those who are aware of TDFs, only 25% have invested in them, and a mere 15% claimed that they are familiar with the features and advantages of TDFs.

Financial wellness is closely linked to happiness

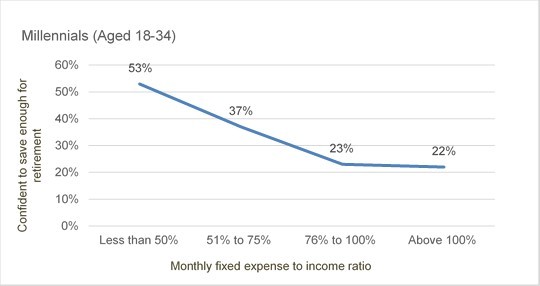

According to the survey results, 87% of respondents indicated that their financial situation is one of the key factors which affects their overall well-being. Monthly income and expenses also have an impact on the young generation's confidence in meeting their financial needs for retirement, therefore, it is instrumental to have a proper and effective budgetary plan. Data indicates that respondents whose monthly fixed expenses remain less than 50% of their total monthly income are more optimistic about achieving their retirement goals.

Source: Fidelity International, Ant Fortune

"It is encouraging to see the savings rates among the young generation in China hit new record highs. We believe the establishment of third-pillar personal accounts and the tax incentives to be offered in the future will further encourage Chinese citizens to increase their retirement savings, which will lay a solid foundation for funding their long-term investment habits,” Rajeev Mittal, Managing Director of APAC ex-Japan at Fidelity International said.

“Fidelity International remains committed to introducing our global experience in retirement investment and planning to China, guiding and assisting Chinese people to become long-term investors and take advantage of the growing third-pillar pension scheme. We are keen to help them enhance their financial wellness and overall well-being."

Guoming Zu, Vice President of Strategic Line, Ant Group, said: "Based on our joint survey with Fidelity International, we see that young Chinese people's awareness of retirement savings has definitely improved over the past years, but saving alone doesn’t mean they are ready for retirement. With the introduction of personal accounts under the third pillar scheme, we need to double down on efforts in investor education and provide one-stop services to help young people reinforce their habits of saving for retirement, and more importantly, support them to improve their knowledge and abilities in investment."

- End -